Charitable and Estate Tactics That Turn Taxes Into Tools

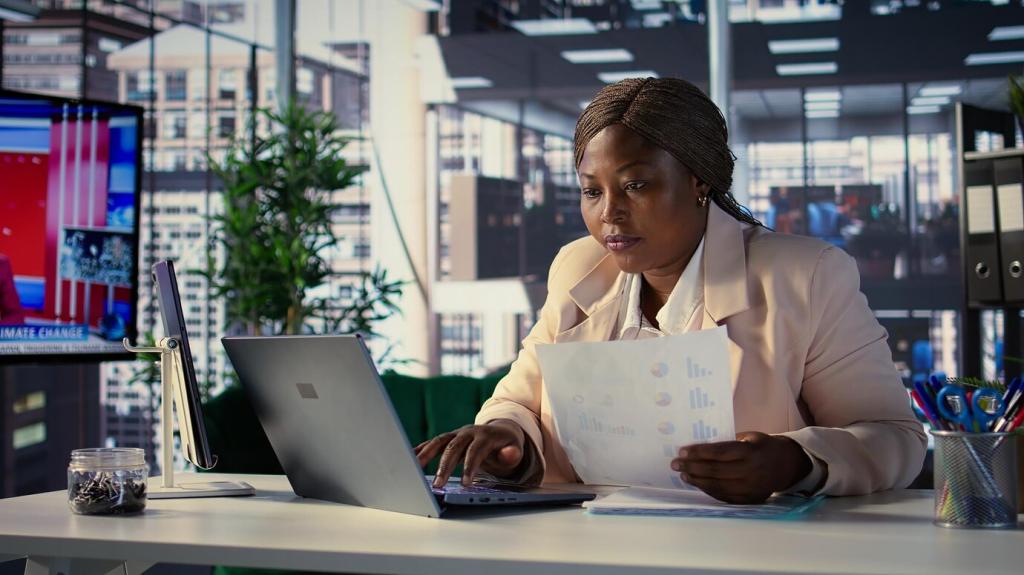

When portfolios drift and you owe gains, gifting appreciated shares to charity or a donor-advised fund removes embedded taxes and preserves deductions. It is a powerful way to rebalance, do good, and keep cash ready for future opportunities.

Charitable and Estate Tactics That Turn Taxes Into Tools

Heirs may receive a step-up in basis, erasing lifetime gains. If estate plans are clear and risk is controlled, deferring taxable sales on certain holdings could make sense. Coordinate with advisors so tax assumptions match your actual intentions.