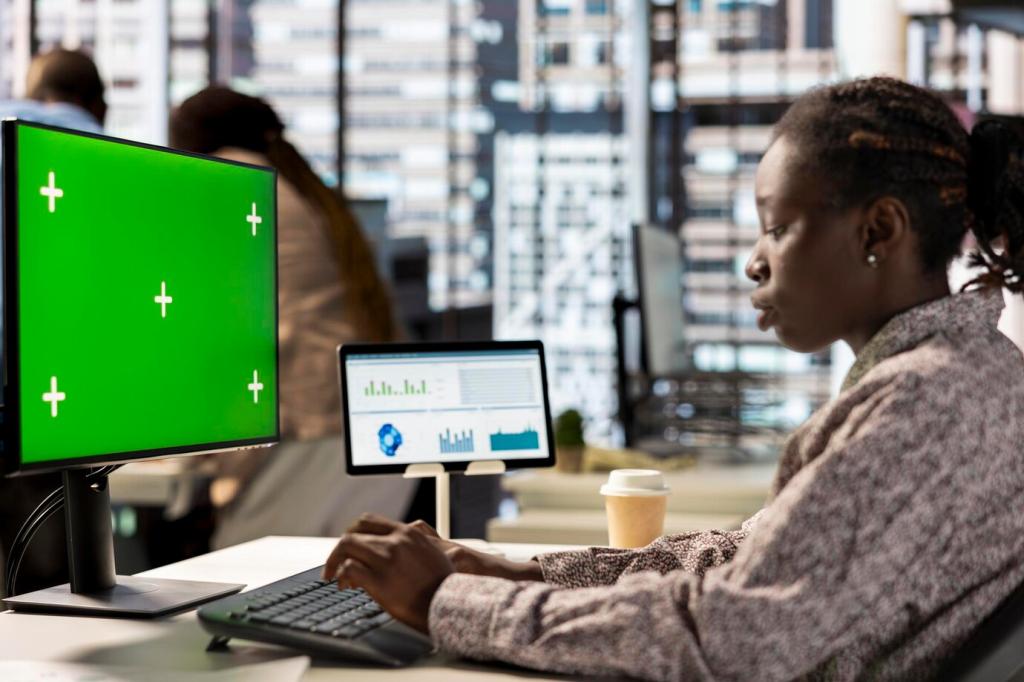

Automated Portfolio Rebalancing Tools: Turn Drift Into Discipline

Automated tools continuously scan positions against target weights, flagging tiny imbalances before they compound into unwanted risk. Instead of occasional check-ins, you get persistent discipline. Tell us how frequently you want alerts, and we’ll share benchmarks from real portfolios.

The Core of Automated Rebalancing: How Tools Keep Portfolios Aligned

Algorithms That Power Rebalancers

Some portfolios rebalance on fixed dates; others trigger only when drift breaches limits. Hybrids blend both, adding a modest calendar nudge to catch slow creep. Tell us your cadence, and we’ll compare trade counts, costs, and tracking error from real-world tests.

Algorithms That Power Rebalancers

Tools may incorporate optimizers that estimate covariance, expected returns, or risk budgets. Simpler rules often outperform noisy forecasts. Share whether you prefer elegant heuristics or heavier math, and we’ll show when complexity helps and when it just looks impressive.

Custodian and broker APIs

Secure connections import holdings, cash, and trade confirmations. Robust tools reconcile differences daily and surface exceptions. Share your custodian stack, and we’ll highlight connection types, refresh intervals, and safeguards that keep your books accurate through busy market days.

Market data, corporate actions, and prices

Reliable pricing and adjustment for dividends, splits, and mergers ensure rebalancing math stays honest. Post about your data delays, and we’ll suggest fallbacks, validation rules, and how to avoid chasing noise during thin trading or fast-moving sessions.

Asset classification and mapping

To hit targets, the tool must correctly label assets by class, sector, region, or factor. Share your taxonomy headaches, and we’ll discuss rule-based and machine-learning approaches that fix mislabels before they distort weights and generate unnecessary trades.

Taxes, Compliance, and Constraints

Tax-aware engines can swap into similar, not substantially identical, exposures while banking losses. Coordination avoids conflicts when harvesting collides with rebalancing. Tell us your lot-level granularity, and we’ll share patterns that minimize tracking error while capturing savings.

Taxes, Compliance, and Constraints

Effective tools identify potential wash sales, protect qualified dividend treatment, and honor minimum holding periods. Comment with your jurisdiction, and we’ll outline rule toggles and exception queues that preserve compliance without paralyzing the portfolio’s daily upkeep.