Avoiding Common Mistakes in Portfolio Rebalancing

Timing Trap: Rebalancing Too Often or Not Often Enough

Rebalancing every tiny market move invites whipsaws, extra spreads, and needless taxes. Weekly tinkering can feel productive, yet often underperforms a patient schedule. Share your cadence experiments, and tell us where frequent tweaks helped—or hurt.

Timing Trap: Rebalancing Too Often or Not Often Enough

Thresholds beat vibes. Many investors use absolute 5% or relative 20% drift bands to decide when to act. Backtest your rules, review annually, and commit in writing. Comment with your favorite thresholds and why they work for you.

Invisible Costs: Taxes, Spreads, and Fees That Eat Returns

Selling winners inside a year may trigger higher tax rates. Consider waiting for long-term treatment when possible, or prioritize tax-sheltered accounts. Share how you balance urgency with tax efficiency without derailing risk targets.

Invisible Costs: Taxes, Spreads, and Fees That Eat Returns

Using specific-lot selection can minimize taxes, yet many default to average cost. Track lot dates, choose higher-basis shares, and document every selection. Comment if your broker’s tools help—or hinder—smart lot decisions.

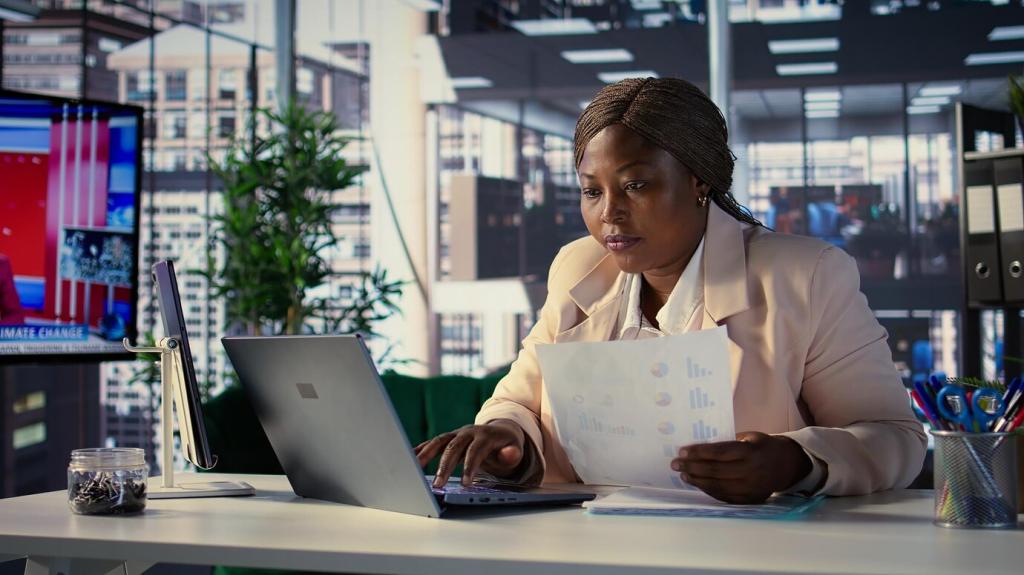

Define target weights, drift bands, review cadence, and the exact steps you’ll take when thresholds breach. Put it on one page. Share your favorite policy line that saves you from second-guessing.

Direct new contributions and dividends to underweight assets first. For windfalls, phase-in funding to manage regret. Comment with how you route cash to minimize trades while nudging allocations back on track.

Include who does what, where accounts live, and the agreed rules for unusual events. Clarity today prevents panic tomorrow. Would a checklist template help? Tell us, and we’ll craft one for subscribers.

Behavioral Biases That Sabotage Rebalancing Discipline

Selling a loser to rebalance often feels like admitting defeat. Frame it as risk control, not capitulation. Have you used pre-commitment rules to override emotions? Share what actually works under pressure.

Behavioral Biases That Sabotage Rebalancing Discipline

Recent winners feel safer, but mean reversion can be ruthless. Rebalancing trims euphoria and funds laggards. Which year tempted you to abandon discipline, and how did you keep your hands off the shiny new trend?

Manage by Household Allocation

Aggregate every account—brokerage, 401(k), IRA, HSA—before making changes. Rebalance where it’s cheapest and cleanest. How do you see the whole forest at once? Share your aggregation approach.

Asset Location as a Rebalancing Ally

House bonds in tax-advantaged accounts and keep tax-efficient equity index funds in taxable, when appropriate. This makes rebalancing cheaper and quieter. Tell us your favorite location tweak that saved real dollars.

Build a Simple Dashboard

A one-page snapshot of targets, actuals, and drift speeds decisions. Color-code breaches and note next actions. Want a template? Subscribe and comment which metrics matter most to you.

Liquidity, Execution, and Market Microstructure Oversights

ETFs trade intraday with spreads; mutual funds execute at end-of-day NAV. Understand premiums, discounts, and volatility. Share when you prefer each vehicle for rebalancing and why.

Liquidity, Execution, and Market Microstructure Oversights

Thinly traded securities can move against you fast. Break orders, avoid the open and close, and respect volume. Have you used volume-weighted execution or limits to steady your hand? Tell us.