DIY Portfolio Rebalancing Tips: Keep Your Investments On Track

Why Rebalancing Matters When You Invest On Your Own

Over time, winners grow and losers shrink, quietly shifting your portfolio’s risk. Rebalancing pulls you back to your original mix, helping you avoid accidental risk creep and the surprises that often arrive exactly when markets turn volatile.

Why Rebalancing Matters When You Invest On Your Own

DIY portfolio rebalancing tips help you systematically sell a little of what has surged and buy what has lagged. This disciplined approach can convert market swings into a steady habit instead of an emotional roller coaster ride.

How Often Should You Rebalance

Pick a consistent date, such as once or twice a year. Put it on your calendar, review allocations, and act only if they drift meaningfully. Consistency beats complexity for most busy investors balancing work, family, and future plans.

How Often Should You Rebalance

If you receive a bonus, sell a property, or roll over an account, consider a rebalance alongside that event. Fresh cash and structural changes are natural checkpoints to realign your investments with minimal disruption and fewer unnecessary trades.

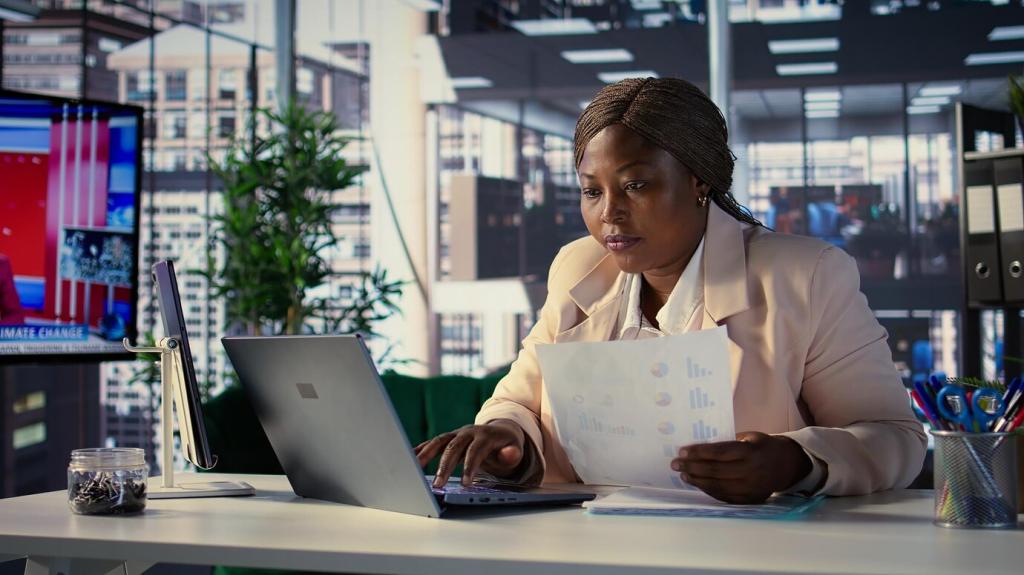

Taxes, Costs, And Smart Places To Trade

When possible, do most sells and buys inside retirement or tax-advantaged accounts to avoid immediate taxes. If you must rebalance in taxable accounts, consider directing new contributions or dividends to underweight assets first.

Behavioral Traps And The Power Of Routine

Name Your Rules Before Markets Sway You

Write your target allocation, bands, and schedule before volatility hits. When prices swing, follow the prewritten rules rather than your emotions. Future you will be thankful for the calm, mechanical clarity in stressful moments.

Avoid Anchoring On Recent Winners

It is tempting to let a surging asset grow unchecked. Remember your plan protects your long-term goals, not last month’s headline. Rebalancing trims exuberance before it becomes concentration risk that can derail years of careful saving.

Accountability Helps You Stick With It

Tell a friend, family member, or the community here about your rebalancing checklist. When others know your plan, you are more likely to follow through. Share updates and subscribe to keep your momentum strong.

Simple Tools And Spreadsheets You Can Trust

01

Create a sheet listing each asset class, target weight, and band. Add current values and formulas that show drift in percentage points. Color coding makes it obvious when an action is needed and when you can relax.

02

Link balances from your brokerage where possible or schedule a monthly five-minute update. Simpler inputs mean fewer mistakes. Over time, a lightweight system beats a complicated one that you avoid maintaining.

03

Add a notes column explaining why you rebalanced, where trades occurred, and the costs or tax considerations. This log becomes your personal playbook, reinforcing consistent choices through changing markets and life events.

Start Today With A One-Page Rebalancing Plan

Choose your asset classes, set target percentages, and add tolerance bands that match your comfort with drift. The clearer your targets, the easier it is to act decisively and avoid endless second-guessing when markets move.

Start Today With A One-Page Rebalancing Plan

Decide on calendar dates or thresholds, and which accounts you will use first for trades. Note tax preferences and costs. A few bullet points turn fuzzy intentions into a reliable routine that practically runs itself.